“We supply more of the superstars, classic catalog and career artists than anybody else.” ~ Sir Lucian Grainge

What the Top 20 artists contribute to their labels market share 📈, analyzing Drake's value to UMG 💰, the latest revenue report by audio streams 💵, and the innovator that David Bowie was 💡

I was taking a look at the nine month marketshare report that the good folks over at Hits put together and started to wonder about how valuable each distributor’s top artists are. How much does The Weeknd contribute to both UMG’s and Republic Records marketshare? How much does J. Cole contribute to Roc Nation’s marketshare or Lil Durk & Rod Wave at Alamo? So I decided to do a little analysis.

Using data from Luminate, YTD through November 3rd, I looked at the total Albums w/TEA w/SEA On-Demand Audio for each Level 1 distributor, as well as the subsequent level 2 and level 3 labels that roll up.

From there, using data from Luminate, I put together a list of top artists YTD through November 3rd ranked by Albums w/TEA w/SEA On-Demand Audio.

I took the number of album units that each artist has moved and divided it by the number of albums that their distributor has moved as well as their label group to figure out how much each artist contributes to their respective distributor and label’s marketshare. Here is the breakdown with rounded numbers.

A couple call outs regarding Distributor & Labels:

At Level 1, the number of albums YTD is comprised as such:

UMG - 253.7M

Sony - 181.1M

WMG - 130.3M

Other - 114.9M

Total - 680M

At Level 1, the composition of the Top 20 Artists breaks down as such:

12 from UMG

7 from Sony

1 from WMG

At Level 2, the composition of the Top 20 Artists breaks down as such:

5 from Republic Records

4 from Interscope/Geffen/A&M

2 from Alamo Records

2 from Columbia Records

1 from Atlantic Records

1 from Capital Music Group

1 from Def Jam Recordings

1 from Epic Records

1 from The Orchard

1 from Roc Nation

1 from SME Nashville

A couple call outs regarding artists:

Taylor Swift makes up about 1% of the overall music business marketshare.

Warner Music Group’s lone representation comes from NBA Youngboy who contributed 2.69% to their overall marketshare. Seems like a pretty significant loss to lose him to UMG.

J. Cole makes up over half of Roc Nation’s overall 0.71% marketshare.

Republic Records top 5 artists (Taylor Swift, Drake, The Weeknd, Morgan Wallen and Post Malone) make up a little under 40% of their overall marketshare. That number will surely go up by end of the year when factoring in the forthcoming weeks from Taylor and Drake.

Kendrick Lamar, Juice WRLD, Eminem, and Billie Eilish account for 9.3M out of the 65.5M albums that IGA has moved this year.

On the Sony side of things, it comes as no surprise that Bad Bunny is pulling his weight contributing 8% to The Orchard’s overall 41.1M albums.

Harry Styles + Beyoncé make up over 10% of Columbia’s 47.3M albums.

As Future figures out his next home, it could be a big score to any label’s marketshare and a huge loss to Epic’s.

In an industry that heavily relies on marketshare as a key metric of success, as an artist, knowing just how valuable you are to your distributor and label is vital.

So what does this look like as far as revenue goes?

Here is a look at the Top 20 Artists based on revenue from streaming audio for the week ending 11/3/22.

Rihanna’s “Lift Me Up” put her back on the chart and next week we’ll see a big spike from Drake as a result of his collaborative project, “Her Loss.”

Speaking of Drake…

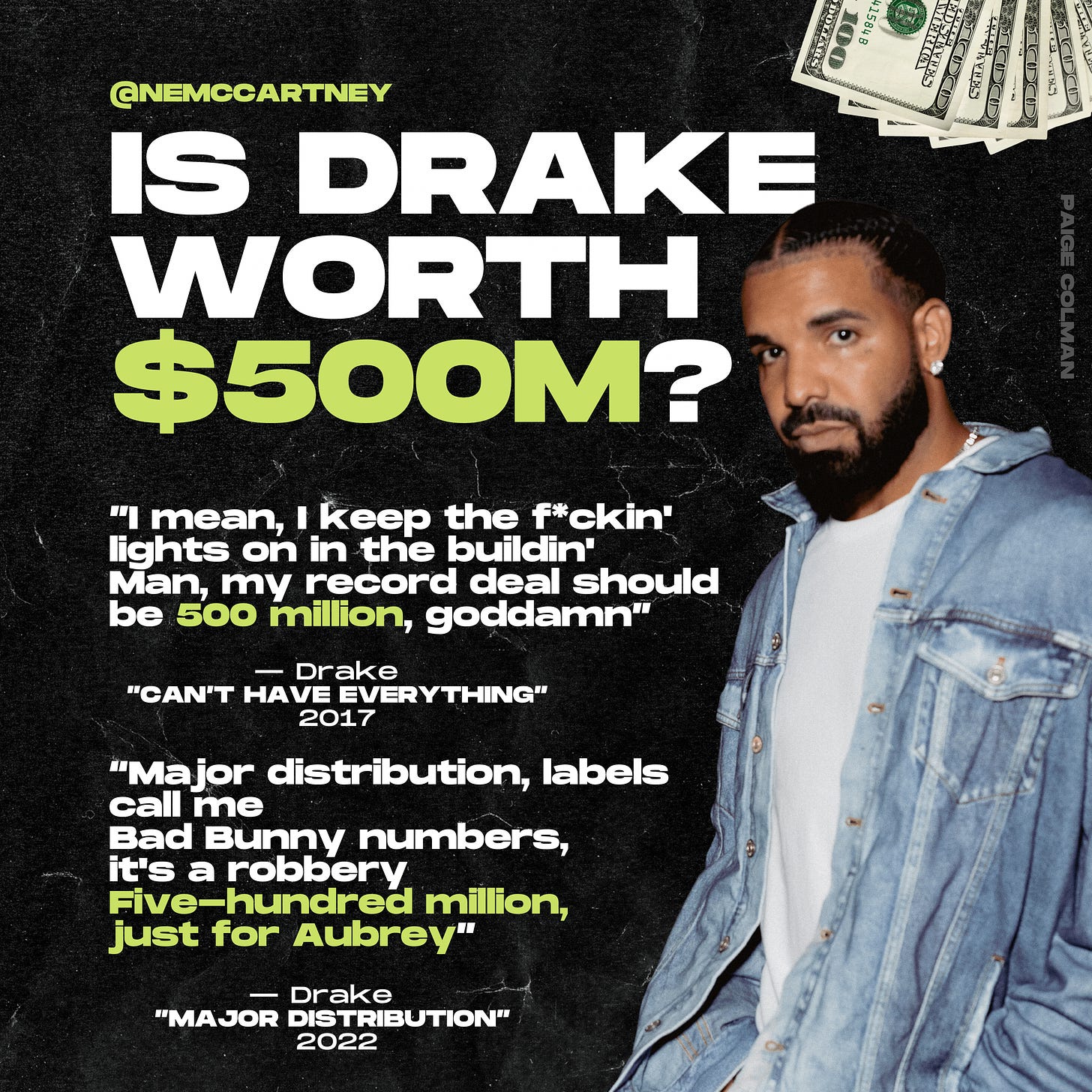

How much is Drake worth?

We’re talking about a guy who has generated 61.3 Billion streams in under 15 years for UMG. 60M albums w/TEA w/SEA On-Demand and he’s still putting out multiple projects a year. Without knowing the exact details of his contract, it’s difficult to put a dollar amount on his value to the business but $500M for an artist who is generating in the ballpark of $50M in revenue annually, it would seem to certainly make sense. Especially when you factor in publishing which was rumored to be apart of the deal.

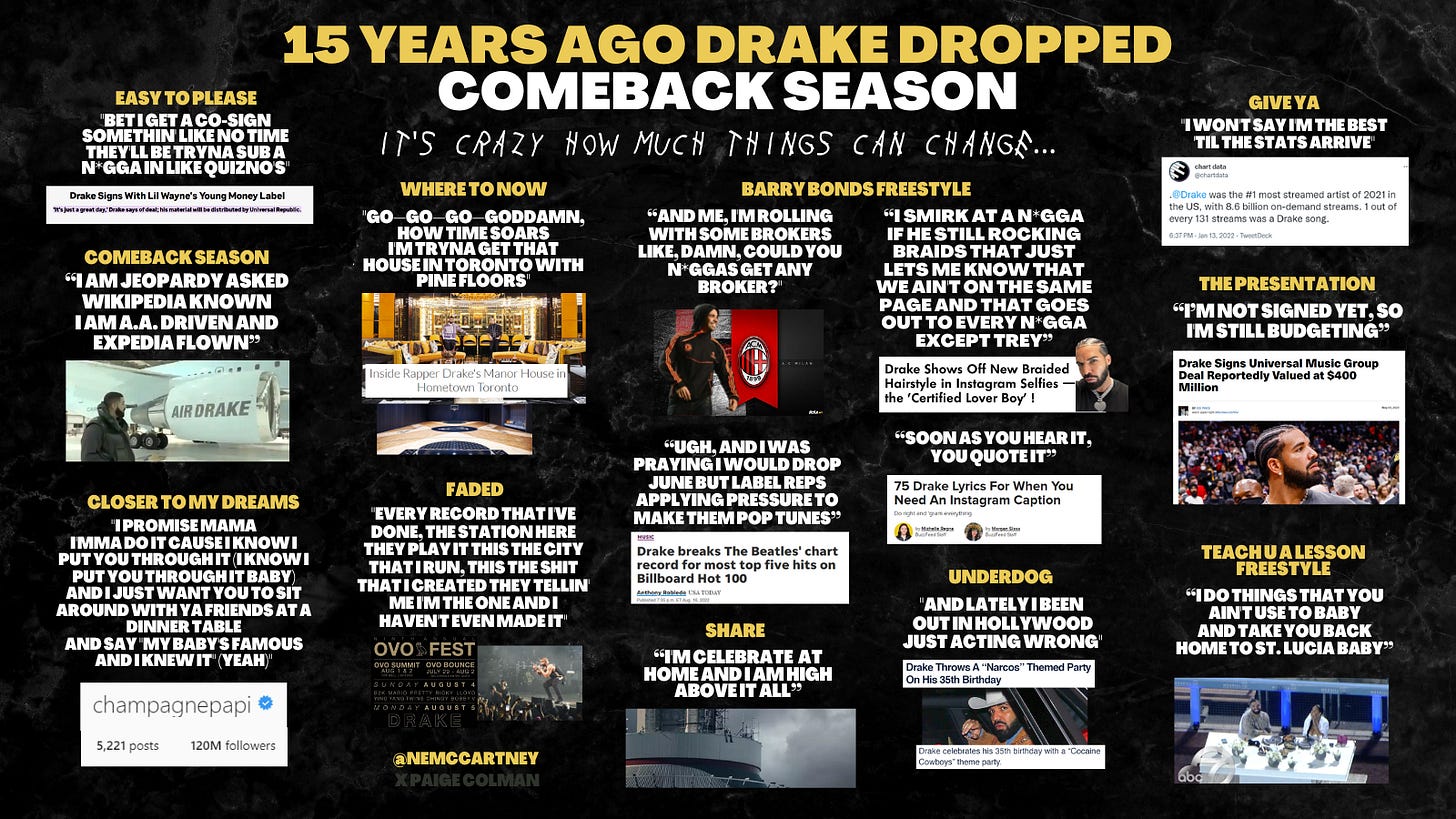

It’s amazing how much Aubrey has accomplished since dropping “Comeback Season” in 2007. Just take a look at what he was rapping about on that project, to what he has actually accomplished. Drake literally manifested his dreams.

Ultimately, Drake’s bars on the Migos’ track “Having Our Way” most certainly seem to be right.

“Billionaires talk to me different when they see my pay stub from Lucian Grainge.”

Rewind…

25 Years Ago David Bowie executed an innovative financial move - raising $55M with Bonds to buy back his master recordings

David Bowie’s life and music career was nothing short of legendary. He’s one of the best selling artists of all time and amassed a fortune rumored to be in the $200M range. However, what’s equally impressive was his business acumen and foresight.

In 1997, David Bowie raised $55M via his “Bowie Bonds” which were asset-backed securities to purchase 50% of his master recording ownership on several albums from his former manager.

Here’s the backstory.

Bowie started working with a shrewd manager and attorney named Tony Defries in 1970. He had a niche for renegotiating contracts and was able to get Bowie out of his existing management, label, and publishing deals.

Tony began to negotiate Bowie’s new record deal with RCA. At that time, not many people knew how valuable rights to recordings would become. Nonetheless, Defries’ canniness led him to negotiate an extremely smart licensing deal with RCA so that his company, MainMan and Bowie would share the net royalties on Bowie’s albums 50-50.

Then in 1975, Bowie and Defries decided to go their own ways. As part of their split, Defries got a portion of Bowie’s revenue for the next 7 years but also retained his 50% ownership stake in Bowie’s RCA recordings.

This is where things start to get interesting.

In the 90’s, Bowie entered into a 15 year licensing agreement with EMI Music for his catalog that included the pop star receiving a $30M advance.

In addition, he entertained offers to sell his master recordings and the portion of his publishing catalog that he owned. That’s when investment banker, David Pullman, approached the singer and his business manager, Bill Zysblat.

As an alternative to selling his IP, Pullman offered up an investment vehicle by securitizing the rights to the royalties from the EMI deal. In 1997, Bowie Bonds were born.

Bowie Bonds, when issued, had a face value of $1,000 with an interest rate of 7.9% and a maturity of 10 years. The bonds were all acquired by an investment division of Prudential Insurance Company and raised $55M.

In order to get the deal off the ground, Pullman had the bonds rated by the three credit agencies at the time. Moody’s gave the bonds an investment-grade rating, indicating that Bowie Bonds were subject to a low risk of default.

With a portion of the money from the bonds, Bowie went to Defries and bought out MainMan’s 50% stake in his RCA masters.

In 2004, the bonds got downgraded by Moody’s from an A3 rating to Baa3 (one level above junk status) as music piracy hurt album sales.

Nonetheless, the Bowie Bonds matured and were redeemed in 2007 as originally planned and the rights to the income from the songs reverted back to Bowie.

Ultimately, Bowie, Zysblat, and Pullman were innovators when they brought together wall street techniques with a music catalog 25 years ago.

Feedback…

If you have any feedback, please leave it or email me at natemccartney@gmail.com

If you like what you’ve read feel free to subscribe and share with friends