Streaming Kingpins: How Drake, Daniel Ek, and Sir Lucian Grainge Make Each Other Rich

They Turned Fractions of Pennies Into Billions—But Will It Last?

“I got enemies, got a lot of enemies…” ~ Drake “Energy”

The music industry has been buzzing since March 2024, when Metro Boomin and Future dropped “Like That,” featuring a fiery verse from Kendrick Lamar that sparked controversy, seemingly aimed squarely at Drake. It’s a topic that’s nearly impossible to avoid. Honestly, it feels like more people have weighed in on this than voted in the last election (kidding... but maybe not?).

In any case, the court of public opinion has been working overtime. This drama has spawned thousands of hours of podcast content, endless comment threads, Complex’s #1 meme of 2024, and a lot of fans exercising their Twitter fingers (stay safe out there). With more twists and turns than an episode of Succession, this saga has given us:

Viral conspiracy theories

The “mysterious man in a baby stroller in Drake’s hotel lobby”

AI-generated diss tracks

Crowdsourced diss tracks

Rampant misinformation

A Super Bowl Halftime Show announcement

And, the pièce de résistance: Drake’s petition against UMG and Spotify

While I’ve been just as captivated as everyone else by the endless developments, the one aspect that stands out to me is Drake’s recent clash with Universal Music Group (UMG) and Spotify.

What makes this situation fascinating is Drake’s decision to challenge two entities that have been pivotal to his success. Of all the targets, he chooses his label and distributor, which hands him “LeBron-sized checks,” and the streaming platform that powers the majority of his streams. It’s a bold move and a real-head scratcher for me.

Let’s focus on the facts. Drake’s meteoric rise has mirrored the streaming revolution, particularly since Spotify’s U.S. debut in 2011. The numbers paint a compelling picture: Drake’s streaming stats, UMG’s revenue, and Spotify’s subscriber base have all skyrocketed in near lockstep over the past decade.

Over the past decade, the growth has been astounding:

Drake’s U.S. on-demand audio streams soared from 2.3 billion in 2015 to a peak of 10.7 billion in 2023.

UMG’s revenue more than doubled, climbing from $5.67 billion to $12 billion in 2023.

Spotify’s global premium subscribers exploded, growing nearly tenfold from 28 million to 252 million in 2024.

This symbiotic relationship is undeniable. UMG feeds Spotify an unparalleled catalog, while Spotify provides a massive distribution platform and powerful promotional tools. Drake benefits from Spotify’s reach and playlists, driving its subscriber growth with his star power. Meanwhile, UMG capitalizes on Drake’s success for market share and revenue, giving him marketing muscle and industry connections in return.

The interdependence between these players makes Drake’s challenge to this ecosystem particularly intriguing. He’s essentially biting the hand that’s helped feed his dominance on the global stage.

Now, let’s dig into some of the claims outlined in Drizzy’s petition against UMG and Spotify.

“Lucian and me are like Kobe and Shaquille, but we never even chill, and that’s the reason going independent it just never had appeal” ~ Drake “Splash Brothers”

The Petition

Spotify Promotion & Streaming:

Drake's Claim: UMG gave Spotify a 30% royalty discount for "Not Like Us" in exchange for preferential algorithmic promotion, without disclosure.

Full Picture: This appears to reference Spotify's standard "Discovery Mode" feature, available to all artists since 2020. The feature takes a 30% commission in exchange for algorithmic boosting and is widely used in the industry. UMG historically hasn't used this feature for major releases.

Bot Usage & Streaming Manipulations:

Drake's Claim: UMG/Interscope paid for bots to artificially inflate "Not Like Us" to 30 million streams in its first days.

Full Picture: While streaming fraud is a serious offense, the evidence presented relies on an anonymous source from a podcast hosted by someone known to be close to Drake. The claim lacks substantial verification.

Influencer Marketing:

Drake's Claim: UMG engaged in illegal payola by paying social media influencers to promote the song without disclosure.

Full Picture: Recent FTC guidance suggests such promotions may be considered similar to product placement, not requiring disclosure when songs are used as background content. Influencer marketing is standard practice in the music industry, with estimates suggesting 75% of popular TikTok songs involve creator marketing campaigns.

Zero-Sum Game Argument:

Drake's Claim: The success of "Not Like Us" directly harmed his economic interests as streaming is a "zero-sum game."

Full Picture: This argument appears questionable since UMG profits from both artists' success. The reputational impact of the song's content likely had more economic impact than any streaming competition.

Content Control:

Drake's Claim: UMG should have prevented or censored Kendrick's song due to its defamatory content.

Full Picture: This position contradicts the hip-hop industry's long-standing fight against taking lyrics literally in legal contexts and raises concerns about corporate censorship of artistic expression.

In essence, while Drake raises some valid concerns about music industry practices, many of his claims seem to target standard marketing strategies—tactics he himself has more than likely benefited from in the past. At its core, this petition feels less about addressing systemic industry issues and more like a personal conflict between the artists.

Unless there is more information to come, it seems Drake is acting like a sore loser, looking for excuses to justify his loss.

The Election

Examining U.S. data from Luminate through December 10th sheds light on the performance of key tracks in this feud (Songs w/SES On-Demand):

Drake featuring J. Cole ~ “First Person Shooter” ~ 2.83M songs

Future & Metro Boomin featuring Kendrick Lamar ~ “Like That” ~ 4.62M songs

Drake ~ “Push Ups” ~ 1.06M songs

Kendrick Lamar ~ “Euphoria” ~ 2.11M songs

Drake ~ “Family Matters” ~ 1.04M songs

Kendrick Lamar ~ “Meet The Grahams” ~ 817K songs

Kendrick Lamar ~ “Not Like Us” ~ 6.58M songs

“This n*gga pulled a rabbit out the hat, and y’all love a magician, it’s funny to see you all rejoicin’ and huggin’ and kissin’” ~ Drake “Fighting Irish Freestyle”

Drake’s accusations of bots, backroom deals, and unfair practices don’t hold up under closer scrutiny. Even Spotify dismissed these claims in their rebuttal (though Russ might have a point with some of his critiques). The reality is much simpler: Kendrick Lamar delivered. "Not Like Us" resonated with listeners on a level few tracks achieve, transforming into a true cultural phenomenon.

Kendrick succeeded at what Drake has long mastered—creating a catchy hook that transcends the song itself and becomes a movement. While Kendrick’s sharp, provocative lyrics added depth, it was the hook that propelled the track into the cultural zeitgeist, making it inescapable.

The numbers back this up. "Not Like Us" not only outperformed Drake’s biggest diss track by 6.5 times in streams but also helped earn Kendrick a coveted Super Bowl Halftime Show performance, five Grammy nominations for the song, and seven Grammy nominations overall.

In essence, the people voted with their streams, and Kendrick won the popular vote. With his Super Bowl selection and Grammy recognition, he also claimed the electoral college. Simply put, Kendrick played Drake’s game—and won.

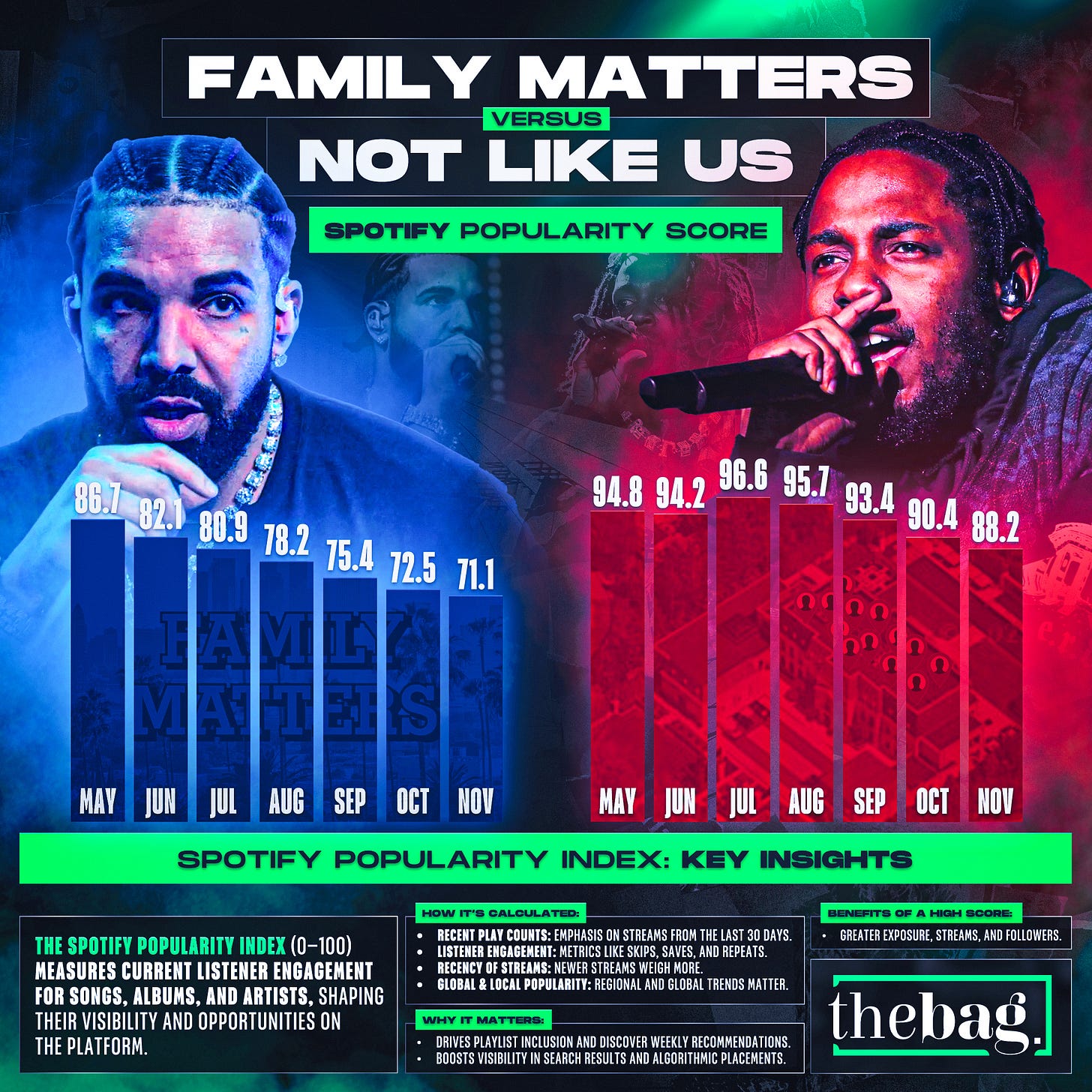

Evaluating the diss tracks analytically, Spotify's Popularity Index provides valuable insights into their performance and underscores key points.

Spotify's Popularity Index measures current listener engagement across songs, albums, and artists, influencing their visibility and opportunities on the platform. The index is calculated based on recent play counts, listener engagement, recency of streams, global and local popularity, and other factors. A higher score translates to better playlist inclusion, Discover Weekly recommendations, visibility in search results, and algorithmic placements. In a nutshell, the higher the score, the greater the exposure, streams, and follower growth.

Examining the performance of "Family Matters" over six months shows the song debuted with a strong score of 86.7 but dropped to 71.1 by November. In contrast, "Not Like Us" launched with an impressive score of 94.8 and maintained momentum, still holding at 88.2 six months later in November.

The decay curves for both songs reveal distinct patterns. Both show a decline over time, but "Not Like Us" had a less steep trajectory, with a little bump between 60 and 90 days before continuing its decline.

Conversely, "Family Matters" experienced a sharp drop in the first 30 days and continued to taper off steadily from there.

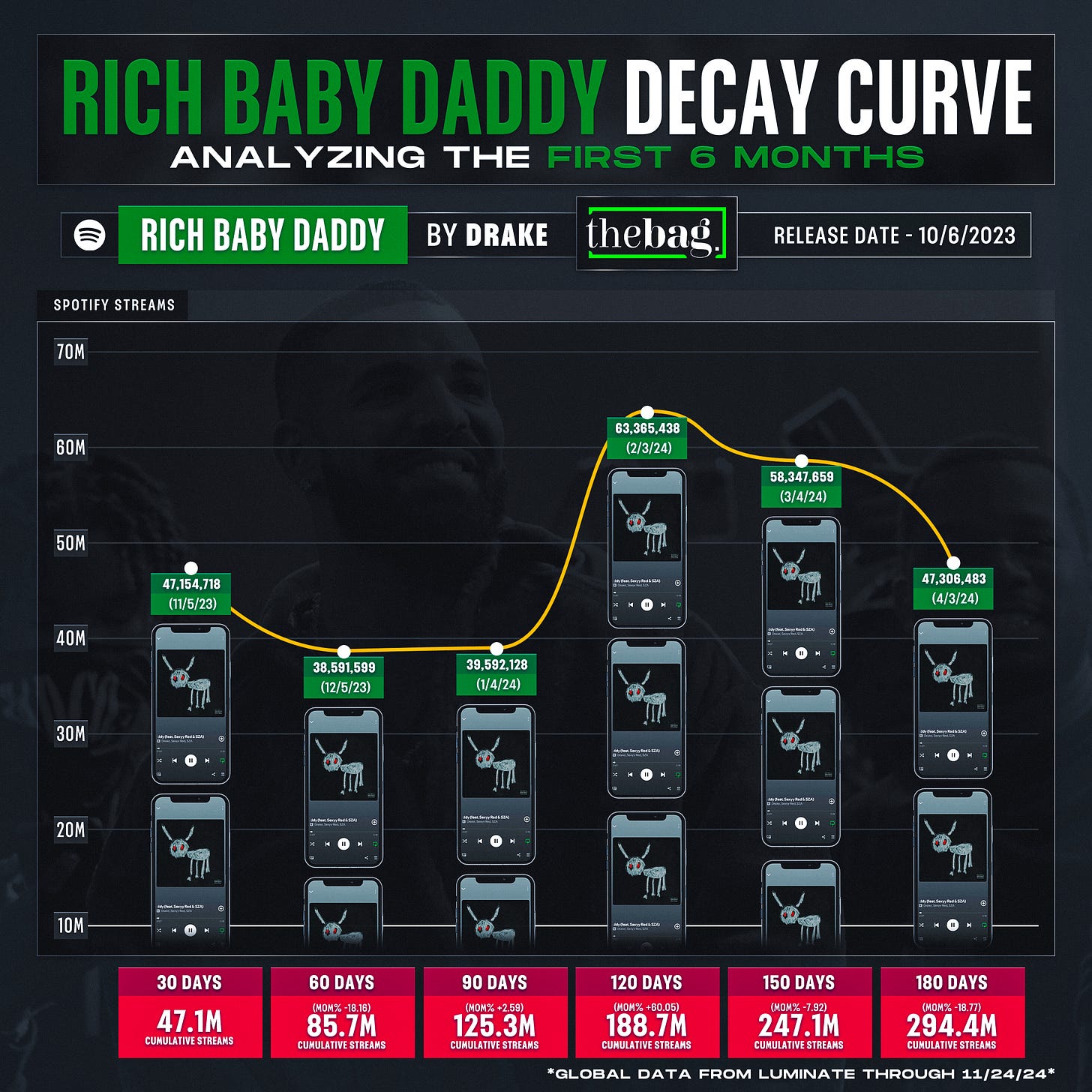

In instances of bot activity, sudden spikes in a song's engagement or streams from atypical geographic regions are often observed. Looking at the decay curve for Drake's most streamed 2024 track as the lead artist, "Rich Baby Daddy" featuring Sexyy Red and SZA, reveals some peculiar trends. The song garnered 47 million global streams in its first 30 days. However, by 120 days post-release, its monthly streams jumped to 63 million—a surprising surge. While this spike might have a logical explanation, its cause is unclear. Perhaps it's just an anomaly, but it raises questions about the underlying factors driving such a pattern.

Putting that aside, Drake’s catalog success is anything but an anomaly. Even in a year without a new project, his sales outpace entire labels and distributors.

According to Luminate, for the full year of 2024 in the United States:

Drake: 7.5M albums w/TEA w/SEA On-Demand

Roc Nation: 3.4M albums w/TEA w/SEA On-Demand

Vydia: 3.7M albums w/TEA w/SEA On-Demand

AWAL: 5.9M albums w/TEA w/SEA On-Demand

300 Entertainment: 6.2M albums w/TEA w/SEA On-Demand

When you consider the artists distributed by these labels, it puts Drake’s dominance into perspective. But the comparison becomes even more striking when you examine Drake’s impact on Universal Music Group (UMG).

“Who the CEO of Universal? They mistaken

‘Cause Google sayin’ Lucian, but that just doesn’t make sense

Who fillin’ up the piggy bank? Who bringin’ home the bacon?

This sh*t don’t come on vinyl, I’m still record-breakin’“ ~ Drake “Away From Home”

For over 15 years, Drake has been a significant contributor to UMG’s bottom line. Looking specifically at the past decade, his contributions stand out:

2015: 5.1M albums (3.1% of UMG’s total 162.9M)

2016: 7.5M albums (4.9% of UMG’s total 153.6M)

2017: 5.4M albums (3.1% of UMG’s total 171.5M)

2018: 9.2M albums (4.2% of UMG’s total 219.9M)

2019: 6.4M albums (2.7% of UMG’s total 238.7M)

2020: 5M albums (1.9% of UMG’s total 263.3M)

2021: 6.4M albums (2.2% of UMG’s total 291.1M)

2022: 6.6M albums (2.2% of UMG’s total 305.3M)

2023: 8.4M albums (2.5% of UMG’s total 341.3M)

2024: 7.5M albums (2.1% of UMG’s total 358M)

For 10 consecutive years, Drake has consistently accounted for at least 1.9% of UMG’s total U.S. consumption—a remarkable feat. The only other artist who delivers comparable numbers is Taylor Swift.

Drake’s consistent dominance underscores his unique position in the industry, not just as an artist but as a driving force behind the success of the world’s largest music company.

The majority of Drake's music consumption comes from streaming, and Spotify leads the market among digital streaming platforms (DSPs). With 252 million premium subscribers, Spotify drives astronomical streaming numbers worldwide.

Not too long ago, Drake and Spotify's Co-Founder and CEO, Daniel Ek, were celebrating major milestone achievements together.

At times, Spotify's support for Drake was so extensive that even his peers and former label mates publicly criticized it.

Drake appears to appreciate Spotify's support when it aligns with his success, yet tensions arise when the platform highlights music that presents competing narratives or challenges his dominance.

“Shit done changed, billionaires talk to me different when they see my paystub from Lucian Grainge” ~ Drake from Migos “Having Our Way”

Let’s take a look at Drake’s 2024 performance from a global perspective:

Drake amassed 18.5 billion global on-demand audio streams for the year.

That’s an extraordinary volume of streams, generating equally extraordinary revenue. To put it in perspective with some quick rounded calculations:

Annual Revenue: $92.3M

Monthly Revenue: $7.7M

Weekly Revenue: $1.8M

Daily Revenue: $253K

Hourly Revenue: $10.5K

Per Minute Revenue: $176

It’s easy to see why Sir Lucian Grainge, CEO of UMG, would have no interest in devaluing Drake’s success. Drake isn’t just critical to UMG’s bottom line—his dominance is central to Grainge’s own legacy.

In an era where major labels have become less dependent on superstar artists, Drake remains an outlier—a true unicorn in the industry. His status is so significant that it prompted bold commentary from gamma’s head, Larry Jackson, during a summer conversation with Joe Budden. Reflecting on Drake’s impact, Jackson remarked:

While the sentiment underscores Drake’s significant influence, the comparison doesn’t quite hold up under scrutiny.

Take a look at the best-selling albums from those decades, along with their reported sales figures:

1970s

"Dark Side of the Moon" – Pink Floyd (50M copies)

"Bat Out of Hell" – Meat Loaf (43M copies)

"Hotel California" – Eagles (42M copies)

1980s

"Thriller" – Michael Jackson (100M+ copies)

"Back in Black" – AC/DC (50M copies)

"The Bodyguard" Soundtrack (45M copies)

1990s

"Come On Over" – Shania Twain (40M copies)

"Jagged Little Pill" – Alanis Morissette (33M copies)

"Metallica" (The Black Album) – Metallica (33M copies)

These combined figures are staggering and dwarf the sales of any single artist today. (Of course, during those decades, people often bought albums for a few songs they loved—today, you just stream the tracks you want.) But perhaps Jackson’s comment wasn’t about pure numbers; it was about Drake’s unparalleled cultural and commercial relevance in the streaming era.

In the U.S. alone, Drake has surpassed 80 million in sales, a testament to the immense value of his catalog. This dominance likely influenced the reported $400-$500 million contract that Sir Lucian Grainge extended to Drake in 2022 to ensure UMG retained both his distribution and publishing rights.

While comparing Drake to entire decades of music might falter under the trained eye, the essence of the claim remains true: Drake is a monumental force in the music industry, and his contributions are impossible to ignore

While many artists have opted to sell their catalogs, Drake took a different approach in 2020. According to documents from the United States Copyright Office, Drake’s entity, Live Write, LLC, entered into an agreement with XXIII Capital to assign the copyrights to 332 songs, including hits like “0 to 100.” This agreement was executed in April, and by the end of October, XXIII Capital had reassigned the copyrights back to Drake.

So, who is XXIII Capital, and what happened here? XXIII Capital is a sports and entertainment financing firm that was led by Jason Traub and backed by billionaire, George Soros. The company is primarily known for financing the transfers of European soccer players but has also been involved in music-related acquisitions.

Notably, XXIII Capital was mentioned during Taylor Swift’s impassioned speech at the 2019 Billboard Women in Music event, where she criticized Scooter Braun and his backers—23 Capital, George Soros, and the Carlyle Group—for their role in financing the Big Machine catalog acquisition.

In Drake’s case, it is most likely that XXIII Capital provided him with a loan, using his catalog as collateral. By the end of the agreement, Drake had retained full ownership of the copyrights, suggesting that the loan was repaid or the terms of the deal were otherwise fulfilled.

As Drake continues to release new music, his catalog benefits from increased streams, bolstered by the ongoing growth of DSPs through subscriber additions and price increases. This dynamic suggests that the value of Drake’s catalog is poised to rise, as its long-term relevance and demand are likely to remain strong—or even grow.

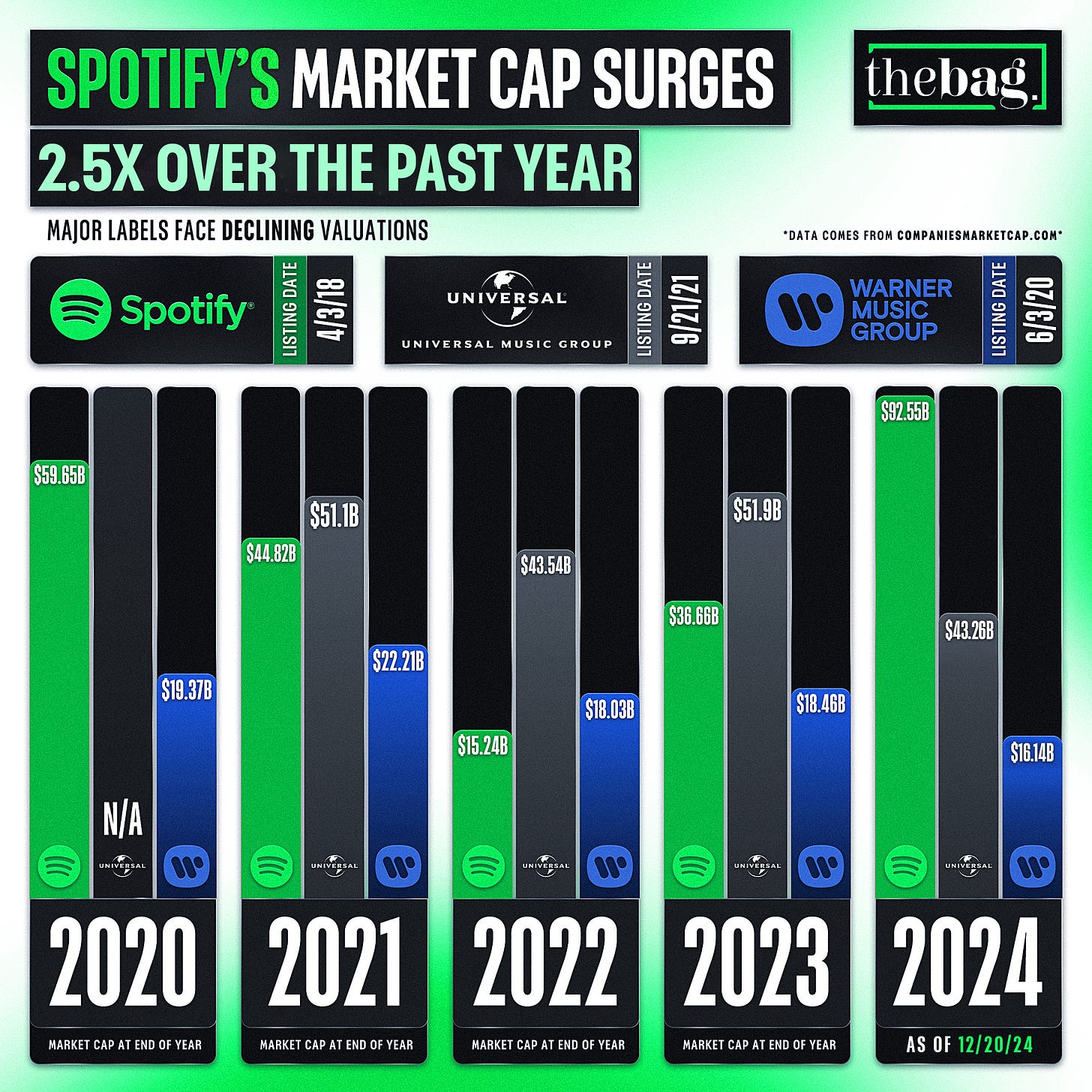

This increasing value is also reflective of broader trends in the streaming industry. Spotify, for instance, recently reached a $100 billion market cap, a significant milestone. At the end of 2023, Spotify’s market cap stood at $36.6 billion, meaning it nearly tripled in value within 12 months. The company achieved this through cost-cutting, subscriber growth, and—perhaps most importantly—relentless innovation in its product offerings.

For over 15 years, CEO Daniel Ek and his team have consistently improved Spotify’s platform. They’ve introduced new features, refined existing ones, retired outdated functionalities, and strategically acquired companies to integrate into the Spotify ecosystem when it made sense to build versus buy. Maintaining a product that keeps over 600 million monthly users engaged is no small feat, and this tireless focus on iteration has been key to Spotify’s success.

“Tell Lucian I said "f*ck it," I'm tearin' holes in my budget” ~ Drake “Stay Schemin’”

Drake, Daniel Ek, and Sir Lucian Grainge are to the music industry what Hyman Roth was to his partners in The Godfather Part II—collaborators who have helped make each other extraordinarily wealthy.

The Wealth Equation

Daniel Ek

As Spotify’s CEO, Daniel Ek hasn’t taken a salary since 2017, but his wealth has grown exponentially through stock sales as Spotify’s valuation has soared:

2021: Ek’s compensation package included $108,000 for security.

2022: He purchased $50M worth of Spotify stock after their Q1 earnings report.

2023: Ek sold $100M in stock in July and another $64.2M in October.

2024: With Spotify hitting record highs, Ek sold $376M in stock across multiple transactions.

Lucian Grainge

As the CEO of Universal Music Group (UMG), Sir Lucian Grainge’s compensation reflects the financial success of the industry’s biggest label:

2021: $303.6M in total earnings, primarily from bonuses tied to UMG’s IPO and milestone achievements.

2022: $49.7M in compensation.

2023: $128.2M in total earnings.

2024: A $5M base salary, with bonuses yet to be determined.

Drake

Drake’s earnings are harder to pinpoint, given the secrecy surrounding his record deal. However, his global streaming numbers highlight the staggering revenue his music generates:

2021: 14B global audio streams.

2022: 16.5B global audio streams.

2023: 21.3B global audio streams.

2024: 18.5B global audio streams.

These streams alone have generated approximately $351.2M in gross revenue from recorded music since 2021—excluding revenue from publishing, digital downloads, touring, and his other ventures.

A Multi-Billion-Dollar Ecosystem

Drake’s music fuels billions in revenue for both Spotify and UMG, while Ek and Grainge’s platforms amplify his global reach. Together, they’ve built a symbiotic empire, turning cultural dominance into staggering financial gains. Spotify’s platform innovation, UMG’s strategic maneuvers, and Drake’s streaming supremacy have reshaped the music business, creating a trifecta of influence and revenue.

Rising Tensions in 2025

Despite this success, cracks in the foundation are beginning to show. Drake’s public disputes with UMG and Spotify—the very institutions that underpin his streaming empire—have raised questions about his future in the industry. Kendrick Lamar, celebrated for his authenticity and cultural impact, continues to thrive, creating a stark contrast to Drake’s increasingly precarious position.

Drake’s catalog remains strong, despite criticism like Not Like Us and other darts thrown from competitors. But as he challenges his label and the most significant streaming platform in the industry, one question looms: Will this gamble pay off, or could it jeopardize his legacy?

As 2025 unfolds, the answers could redefine not just Drake’s career but the future of the music industry itself.

“All I know is that God got me, I’m sittin’ on large properties

Treat me like a newborn, Lucian not droppin’ me” ~ Drake “Middle of the Ocean”