Who do you bank with?

Do you know who your record label banks with?

This might seem like a frivolous question, but for the second time in 15 years, it’s proven not to be.

The US just experienced the second biggest banking failure in its history.

A collapse that could have dramatically affected the lives of millions of people.

And while many in the tech world are burnt out from an exhaustive five days of news about Silicon Valley Bank’s demise, in my conversations with various folks in the music industry, it didn’t even come up.

If you aren’t up to speed, let me give you a quick summary.

US venture capital-backed companies raised $330 billion in 2021 — almost doubling the previous record a year before. Silicon Valley Bank is the bank of choice for many VC’s who also encourage their startups to utilize the bank.

SVB’s books went from $60B in deposits in 2020 to $200B in 2022. But since lending services weren’t needed due to the fact that individuals and companies were already flush with cash, SVB had to find an alternative use for their deposits. This led the bank to put the money into government-issued or government-backed long term securities.

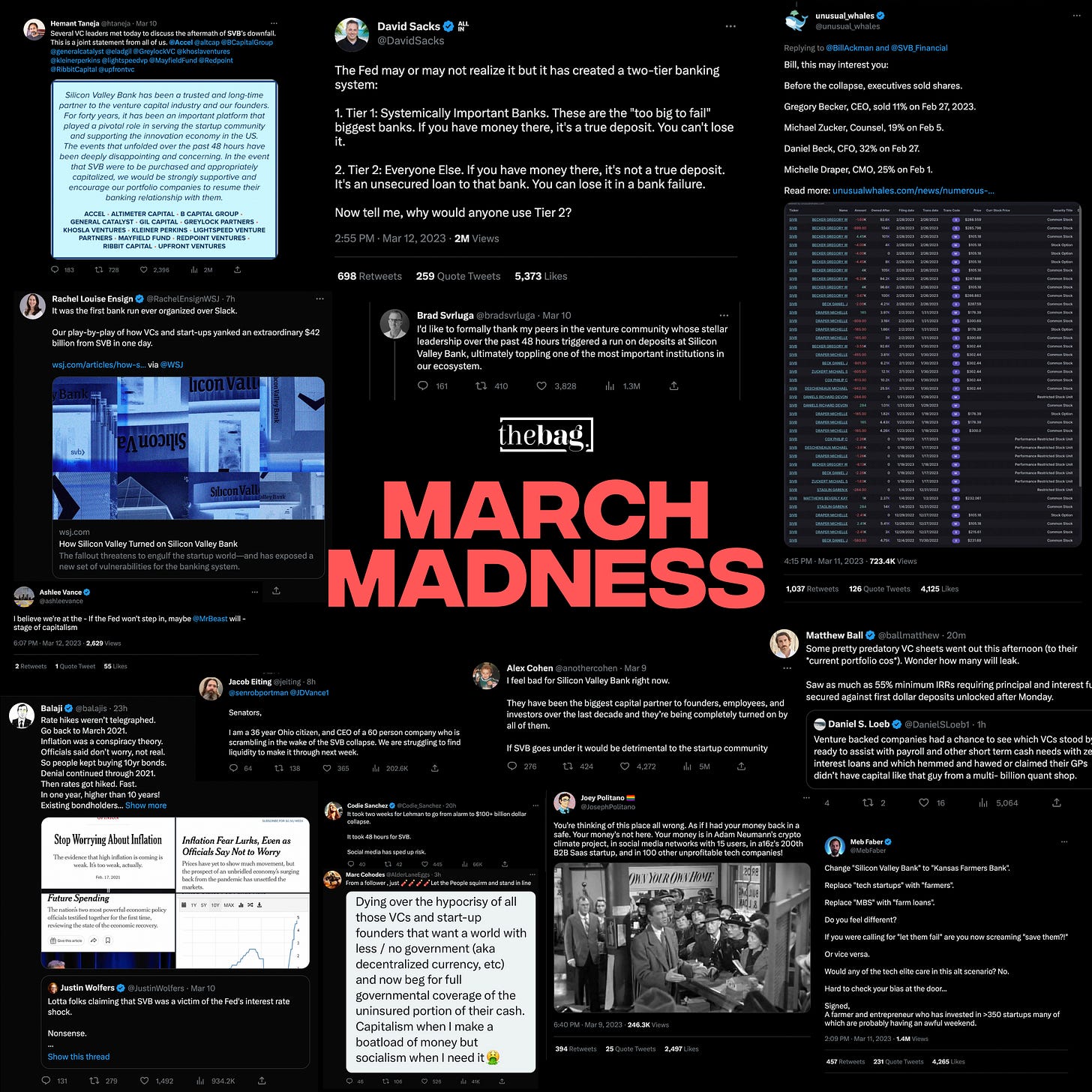

These bonds felt like a safe play so SVB didn’t hedge against them. Then interest rates got hiked up by the Fed at a rapid speed and the bonds started to lose value. SVB was facing a downgrade from Moody’s and needed to raise $2.25B to shore up its books. Account holders at SVB got spooked and the bank run began.

The result? $42B in attempted withdrawals before the FDIC took over as receiver on Friday.

The FDIC only insures bank deposits of up to $250,000 — and SVB’s clients had much more. That meant a large share of the money stashed at SVB was uninsured: more than 93% of domestic deposits as of Dec. 31, according to a regulatory filing.

SVB had mark-to-market losses in excess of $15 billion at the end of 2022 for securities held to maturity, almost equivalent to its entire equity base of $16.2 billion.

To further emphasize the magnitude of this, SVB was serving half of all venture-backed companies in the US and 44% of the venture-backed technology and health-care companies that went public last year.

Last night, after a tumultuous weekend, the Biden administration announced a bail out where all depositors will receive access to their money today potentially showing that banks are too big to fail.

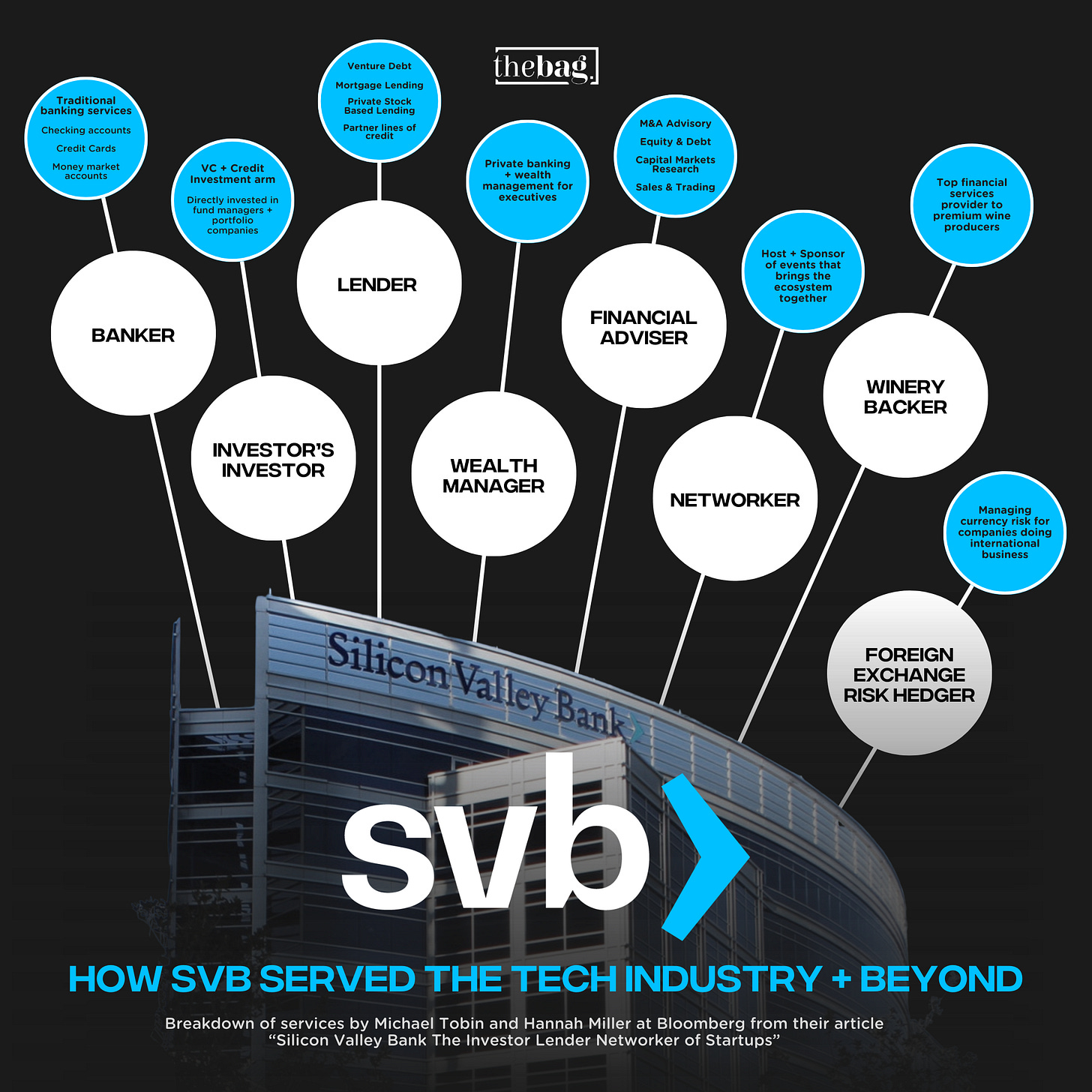

Silicon Valley Bank has a plethora of services which makes it attractive to many tech companies. It’s not just tech companies though.

Startups raise money from venture capitalists who raise money from limited partners. Those LP’s are often endowments, pension funds and extremely wealthy individuals.

Startups build companies that have employees and vendors. Money is oxygen to startups. If they don’t have oxygen they die. If a startup can’t pay its employees it dies. If a startup doesn’t pay a vendor, that vendor can’t pay its employees and it dies. When the system breaks, all of a sudden we have lots of people without a way to bring in income which affects everyone.

The music industry has been on a tremendous high the past several years. There were IPO’s from Warner Music Group + Universal Music Group. Recorded music revenues in the United States have grown for seven consecutive years. Music rights acquisitions were greater than $5B in 2021.

United Masters, Gamma, and a flock of web3 and music startups raised significant capital.

What does this have to do with Silicon Valley Bank and why does this matter?

If we’ve learned anything from former Bag Drops, it’s that we should follow the money.

Some of the same folks that banked with SVB, not necessarily in totality, but had exposure to this unfortunate situation are the same ones pouring capital into the music ecosystem or supporting the music ecosystem.

Accel Partners and Kleiner Perkins were investors in Spotify’s later stage growth rounds.

Andreessen Horowitz funded multiple rounds for United Masters and many of the web3 companies that are providing opportunities for artists to monetize on the blockchain.

True Ventures and Union Square Ventures are investors in Splice.

Upfront Ventures was an early investor in Stem.

Kleiner Perkins and Union Square Ventures are backers of Soundcloud.

If you want to take a step back, you can look at the bigger consumer and social media companies that are apart of nearly every artist’s marketing plan and the money will trace back to an entity that worked with SVB.

Whether that’s Benchmark (Snap), a16z and Accel (Meta), Floodgate (Twitch + Lyft), Sequoia (Uber), etc.

The majority of the time, the best venture capital firms invest in the best startups and for many of them they utilize SVB.

And like the tech ecosystem, the power dynamics in the music industry are tightly intertwined.

Cherie Hu from Water & Music does an excellent job of demonstrating this with this visual.

In the case of this banking collapse, multiple VC’s are alleged to have told their portfolio companies to pull their money from SVB which started the bank run.

And it makes me wonder, what happens if the music ecosystem turns on itself as it’s all intertwined?

We’re starting to hear the top label brass push harder for a new streaming model. Meanwhile, Spotify, who the majors invested in, already has extremely slim margins.

Spotify has paid out almost $40B in life time payments to the music rights holders yet they’ve never turned an annual profit.

As streaming growth slows down, it will be interesting to see how the pressure from the public markets affects the relationship that the majors have with Spotify, the other streaming services, and emerging platforms that utilize music.

Tiktok is already playing hardball with their test in Australia where they’ve pulled some of the major’s music from their service to see what the value of major label music is on their video platform. While Lucian Grainge says that he already knows how this movie ends, the US government might have an alternative ending.

Triller, once viewed as promising opportunity for the music industry, turned out to be a bi-polar company that fudges numbers.

Unlike the banking industry, there has never been a music bailout. But like the tech industry, there will be no shortage of opinions and finger pointing if revenues start to go south.

While we’re on the topic of banking and the music industry. A crazy story from 60 years ago.

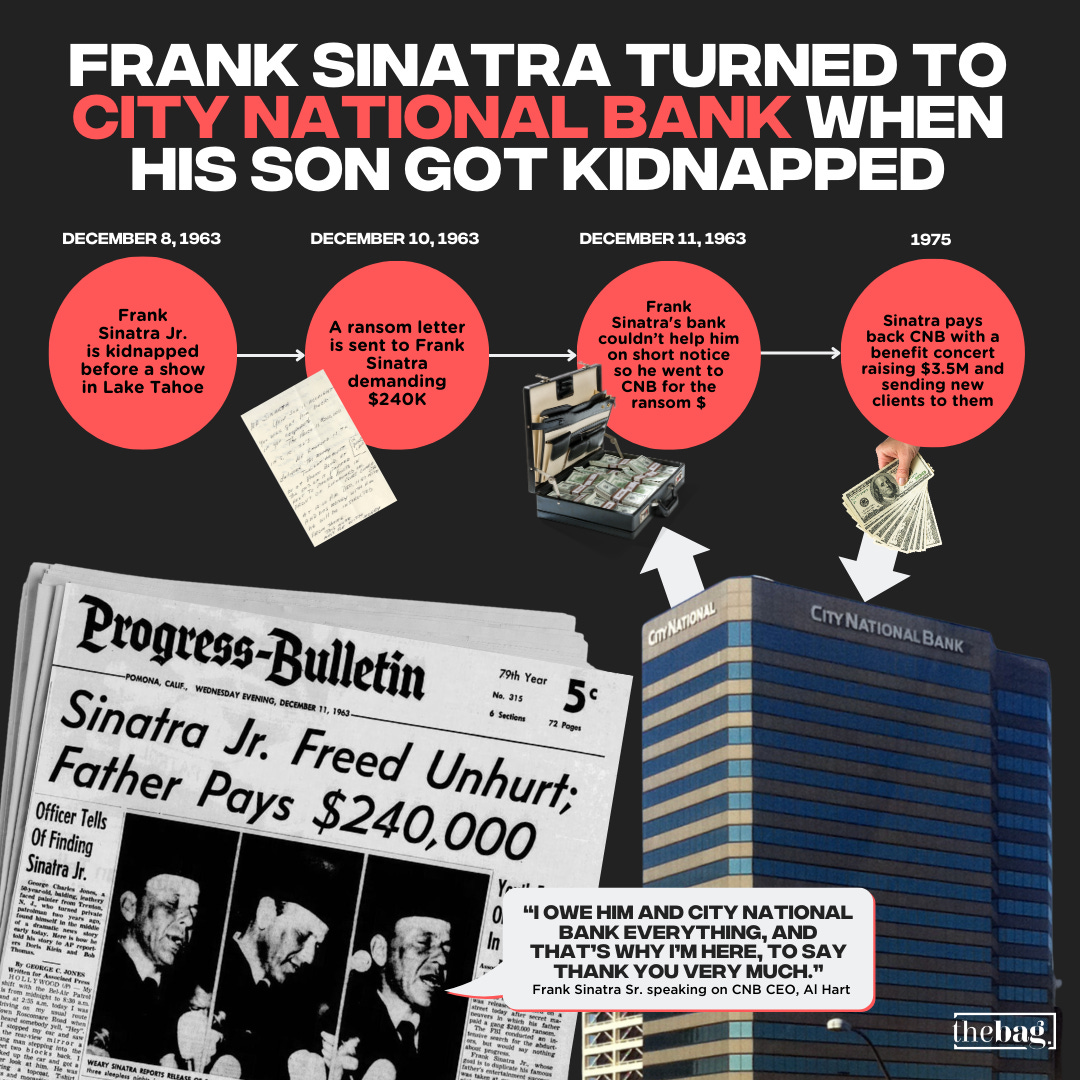

Frank Sinatra Sr. turned to City National Bank when his son got kidnapped and held ransom.

In 1963, the 19 year old son of Frank Sinatra was kidnapped before a show in Nevada by some former friends. The plan was simple. Kidnap the son of “Old Blue Eyes” before his show and then hold him for ransom.

Just days after the assassination of President John F. Kennedy, Sinatra Jr. was scheduled to perform at the Harrah’s Club Lodge in Lake Tahoe.

Prior to the start of the show, Sinatra Jr. was in his dressing room with a friend when there was a knock on the door. Pretending to be delivering a package, the two kidnappers entered and quickly tied up Sinatra Jr.’s friend with tape. Then they blindfolded the singer and exited through a side door.

The singer’s friend quickly freed himself and notified authorities. Roadblocks were set up, and the kidnappers were actually stopped by police, but they bluffed their way through and drove on to their hideout in a suburb of Los Angeles.

The FBI quickly got involved and presumed that Jr. would be held for ransom and they should wait for a demand and then pay it. They were correct. The following night a 3rd conspirator reached out to Sinatra Sr. and demanded $240k in cash.

The legendary singer reached out to his bank but was unable to get the cash on short notice. So he turned to his friend, Alfred Hart. Al was the founder and CEO of City National Bank. Al provided Frank Sr. with $240k in marked bills so that ransom could be paid.

The FBI made the drop and one of the conspirators got nervous and freed Sinatra Jr. From there the cookie started to crumble. While Frank Jr. couldn’t provide a visual description since he was blindfolded, the conspirators started to get nervous and told others about what they had done. Shortly thereafter, they were arrested and eventually convicted for the kidnapping.

Frank Sinatra Sr. repaid Al Hart and then some. Not only did he pay back the $240k but he also performed at a benefit that raised $3.5 million from hundreds of Hollywood A-listers to help build the Alfred and Viola Hart Tower at Cedars-Sinai Medical Center.

And most importantly, Sinatra Sr. told Hollywood A-Listers that they should take their banking to City National Bank. That’s how City National Bank became the bank for the stars.

The best part, City National Bank’s founder and CEO, Al Hart was a former wholesaler of beer for the Capone organization, had eight arrests related to illegal games of chance at a cigar store he ran in downtown L.A., and had a stake in the Benjamin “Bugsy” Siegel partnership that built the Flamingo Hotel & Casino in Las Vegas.

If you like what you’ve read and want to support…

Feel free to subscribe, share, or leave feedback.

Or if you’d like to support me and the things that I’m passionate about in another way, I’ll be running my 12th marathon and 4th Boston Marathon this April.

As a die hard Boston Celtics fan I run on behalf of the Boston Celtics Shamrock Foundation whose mission is to help underprivileged children in the New England Area. If you’d like to donate to this cause, you can do so here. Every little bit helps.