Board Games

A look at the board of directors at top music companies, WMG + UMG's diversified portfolios, Len Blavatnik's fortune, Elliot Grainge's 10K Projects, Fred Davis, and AI Agents

"Information Greg, is like a bottle of fine wine. You store it, you hoard it, you save it for a special occasion and then you smash someone's face with it." — Tom Wambsgans

It’s been an interesting couple of months in the world and depending on what you’ve been consuming, the lines between fiction and reality can quickly become blurred.

The east coast spent a week smelling like a chimney, we had a former President get indicted, a current President’s son taking plea deals, Floyd Mayweather boxing John Gotti III, a 7am knife fight on 30th and 7th ave, Conor McGregor accidentally knocking out a mascot, Kelis living her best life with Bill Murray, billionaires getting on submarines that are being operated with video game remote controllers, Mark Zuckerberg and Elon Musk coordinating a cage match, and Zion Williamson wishing he knew how ephemeral messaging works.

It makes one wonder, is this real life or a terribly scripted television series?

What’s not a terribly scripted television series? Succession.

A few weeks ago, Jesse Armstrong’s masterpiece closed its curtain with the Waystar Royco board meeting. While the show is fictional, many elements of it have resembled real life, at times more so than what one might see on the news. In the end, Kendall Roy couldn’t get the votes at the board meeting, but in real life, there have been some interesting happenings at the board level of various music companies.

“I Love You And I’m Glad You’re A Part Of My Life, But I Am Taking Legal Action Against You.” — Greg Hirsch (Cousin Greg)

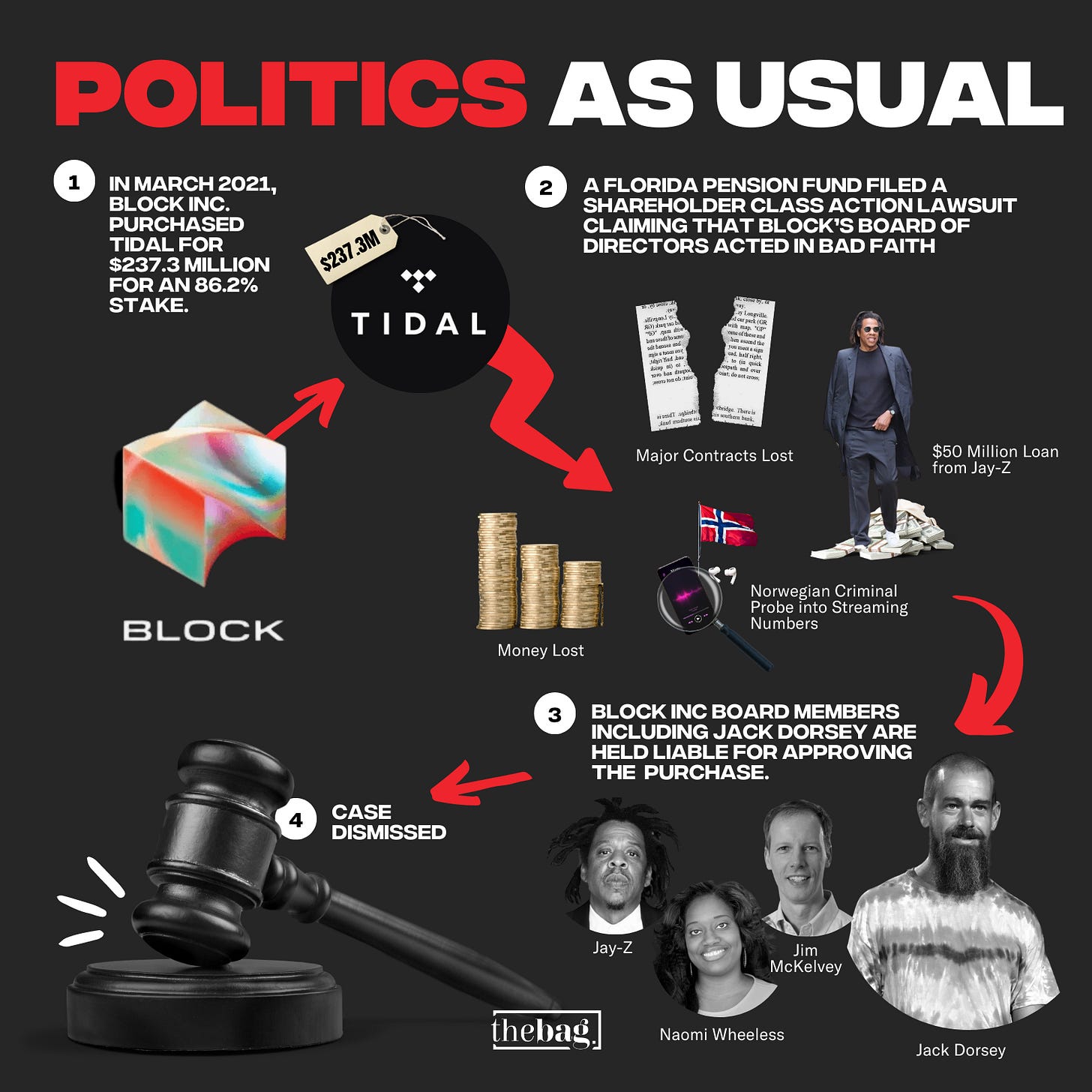

In early May, a Delaware judge dismissed a shareholder class action lawsuit brought by the City of Coral Gables Police Officer Pension fund against Block Inc. The lawsuit sought to hold Jack Dorsey and other board members at Block Inc. liable for approving the purchase of Tidal.

As a refresher, Block bought Tidal in 2021 for $306 million. After adjustments, it paid $237.3M for 86.2% of the company (valuing the streaming service at roughly $270M).

The lawsuit called out that Tidal was losing money, lost contracts, had a pre-existing probe in Norway from alleged streaming manipulation, and needed a $50M loan from Jay-Z to shore up its finances.

Chancellor Kathaleen McCormick in Delaware Chancery Court stated that while the purchase "seemed, by all accounts, a terrible business decision" Jack Dorsey and the rest of the board of directors did not act in bad faith.

Whether or not you agree with Chancellor McCormick, what I find compelling is that Mr. Carter was willing to put in $50M of his own money to keep the company going. During these times when most people are spending someone else’s money, you have to tip your hat to those that bet on themselves with their own money. It looks like it worked out in the end.

“I’m sure you are where you are for a very good reason.” — Joy Palmer

Warner Music Group added Sir Len Blavatnik’s son, Val Blavatnik to their board of directors in late April.

Prior to Val’s addition, billionaire investor Thomas H. Lee, who previously served on WMG’s board for two decades, passed away in late February.

Val should add some new and fresh perspective to the board that’s been spearheaded by Chairman, Michael Lynton. Mr. Lynton is also the chair of Snap Inc. and a widely respected businessman.

This comes early in new CEO Robert Kyncl’s tenure heading up the third biggest major label group.

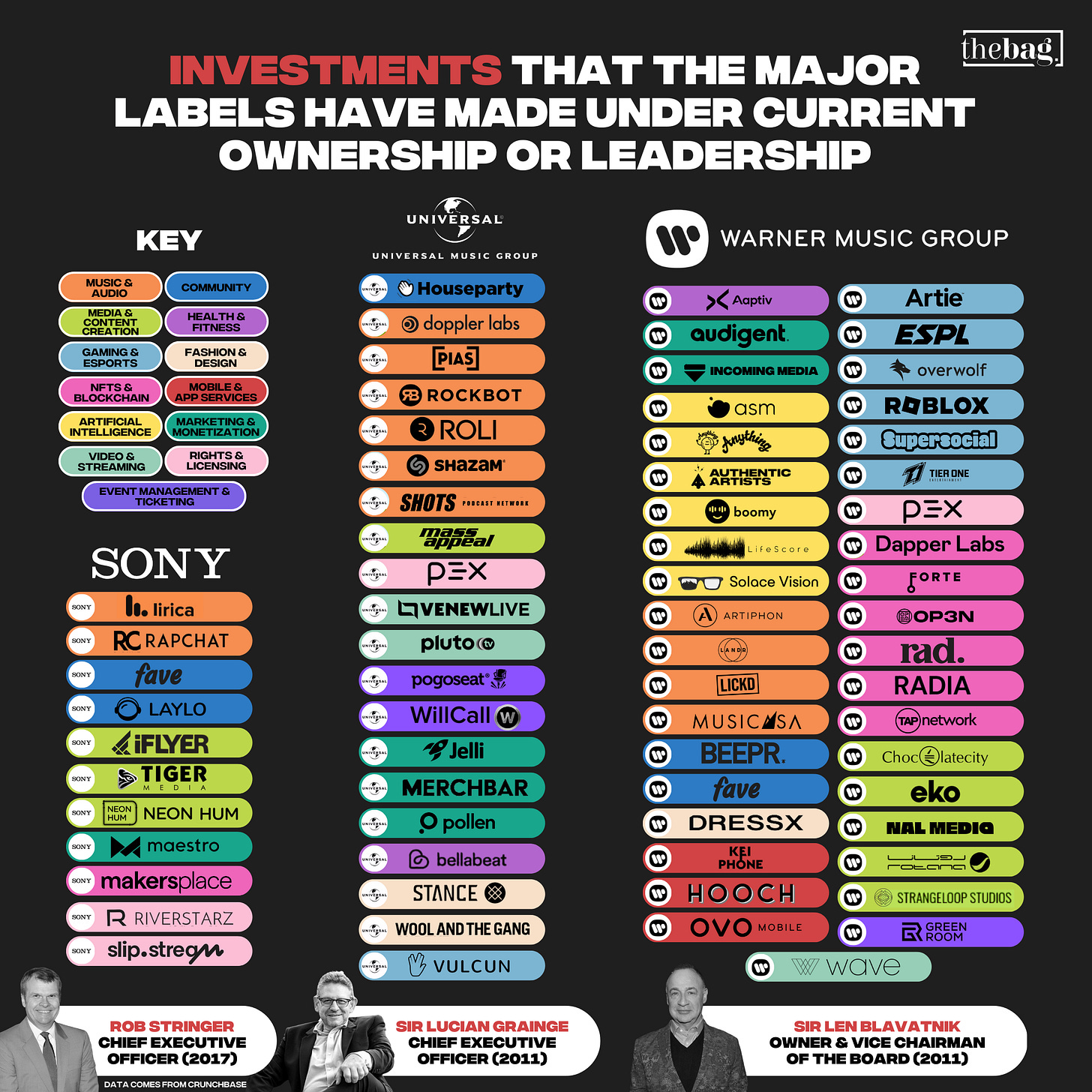

Since Len Blavatnik bought the company in 2011, WMG has gradually transitioned from a traditional music company to a media company that supports its artists in a variety of ways and meets its audience and fanbase where they are.

“I give the customer what he wants. I don’t think it’s my place to offer dietary advice. If they want red meat and boiling tar… then buon appetito.” — Tom Wambsgans

In addition to their labels and publishing divisions that have been bolstered with acquisitions including 300 Entertainment, Artist Partner Group, and Parlophone, WMG has also been aggressive in the podcast, content, and investment space.

Their podcast division, Interval Presents, has struck deals with Drink Champs and Rap Radar amongst others. WMG acquired Uproxx, HipHopDx, and a network of social channels including Daquan through their purchase of IMGN.

They also acquired Songkick and merchandising company EMP, launched a startup accelerator called WMG Boost, and made investments in flourishing startups including Dapper Labs, Forte, and Wave.

As MBW covered, former CEO, Stephen Cooper shared in one of his final interviews before leaving the company last year, “In running our portfolio, what we’ve done over the last number of years is reduce our [financial] dependency on superstars. [And] reducing that dependency has allowed us to continue to reinforce our approach to A&R, which is long-term artist development.”

Cooper added, “We try and find artists at the beginning of their career, so that we can build their career with them, but [via] a set of economics that we believe are reasonable and rational, as opposed to economics that we often observe in other deals that frankly we don’t understand.”

One could surmise that if you keep a&r costs down instead of overpaying on every hot deal, some of that money could potentially be repurposed elsewhere. Additionally, like an a&r betting early on an artist to succeed, WMG is making its own bets in the startup space where the payoffs could be much larger.

And while WMG has been a great asset for Len Blavatnik, buying it for $3.3B in 2011 and worth approximately $13B today, he’s had no shortage of success across a variety of industries.

"Here's The Thing About Being Rich: It's F--cking Great. It's Like Being A Superhero, Only Better." — Tom Wambsgans

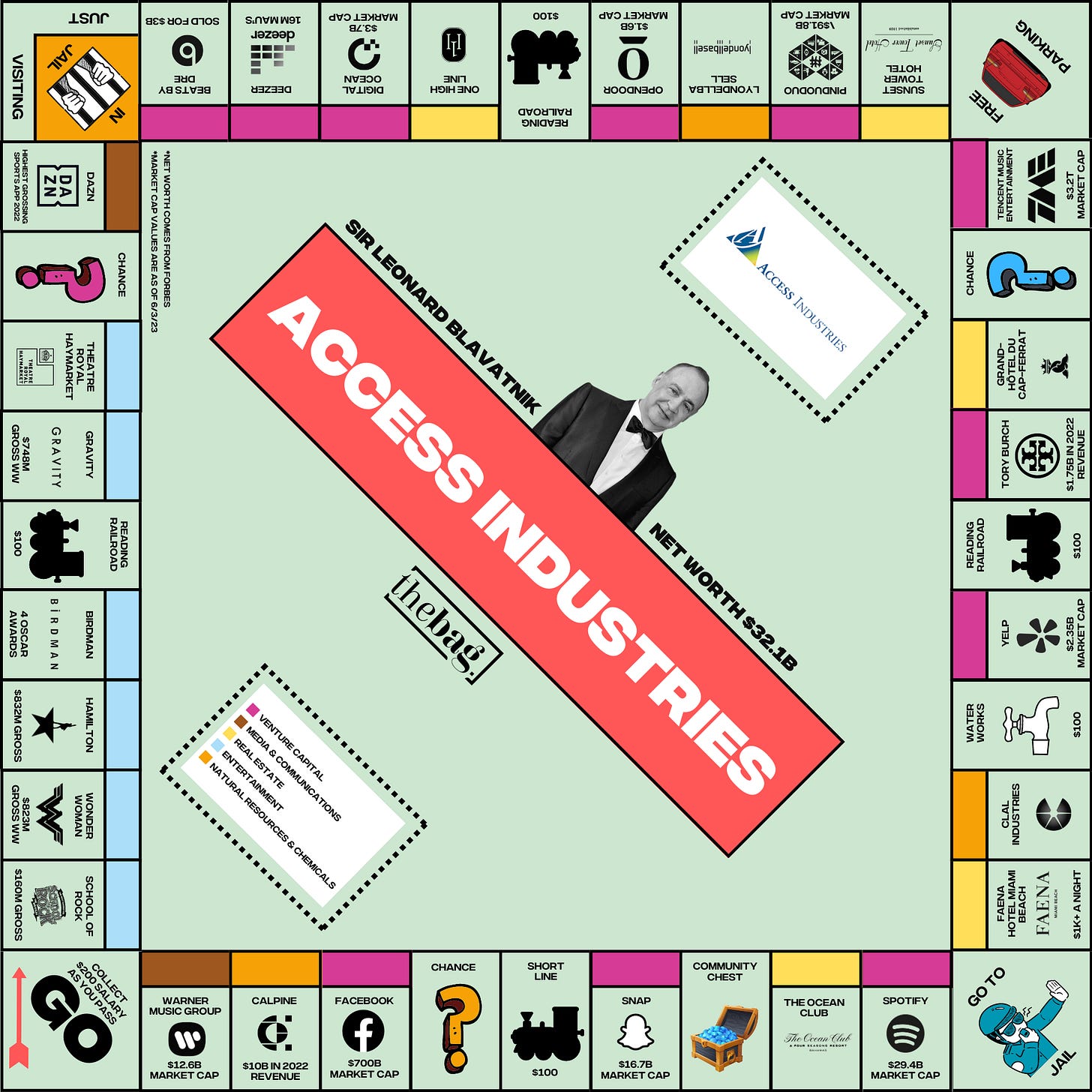

Sir Leonard Blavatnik is about as rich as they come. Forbes has him listed as one of the top 50 richest people in the world. While his net worth has fluctuated based on his companies current success, it’s consistently been over $30B.

His parent company, Access Industries, has its claws in a plethora of things.

Their entertainment arm finances incredible Broadway shows including Hamilton, School of Rock, and Moulin Rouge!

On the movie end, they’re responsible for films like Gravity, Birdman, and Wonder Woman.

From a music and media perspective, they have DAZN, Deezer, and Warner Music Group.

On the investment side, Access Industries has stakes in Snap, Facebook, and Pinduoduo. Tencent, another portfolio company, is worth hundreds of billions of dollars.

America’s premier power generation company, Calpine, did $10B in 2022 revenue.

Blavatnik’s real estate portfolio is just as amazing with ownership in the Ocean Club, Faena, One High Line, and Grand Hotel Du Cap-Ferrat.

Len is extremely shrewd and he keeps smart people around him like Lynton and former TikTok CEO and current Candle Media Co-CEO, Kevin Mayer among his various company heads.

Clearly, he knows what he’s doing and it’s been paying off in a big way.

While there are levels and distinct differences between being an owner and a CEO, there are plenty of CEOs who are doing well for themselves.

"$5 million is a nightmare. Can't retire, not worth it to work. Five will drive you un poco loco, my fine-feathered friend." — Connor Roy

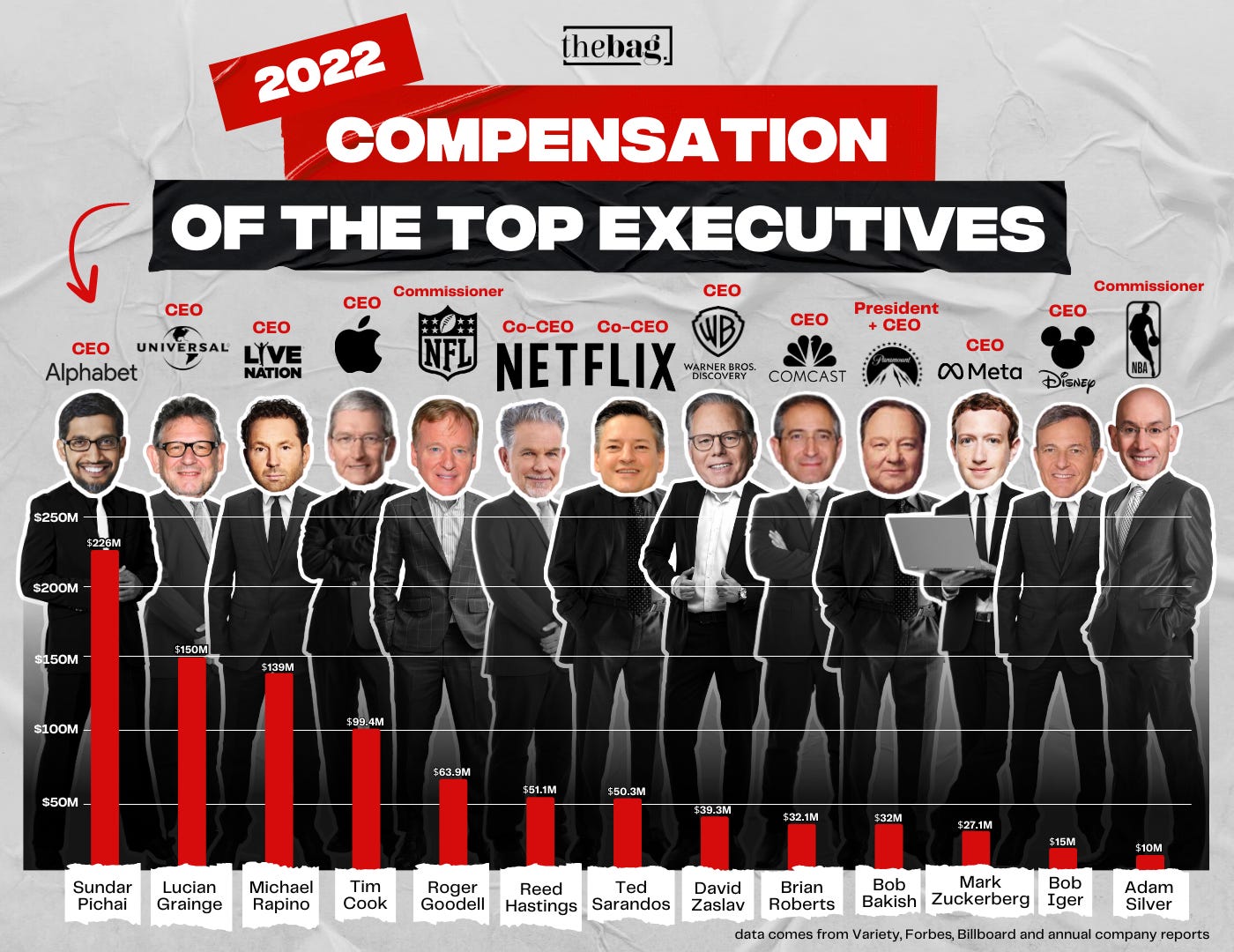

A few weeks ago, Brent Lang, Jennifer Maas, and Todd Spangler from Variety put together a great summary on media CEO compensation in comparison to company performance.

With the recent news that Universal Music Group CEO, Sir Lucian Grainge was compensated $150M in 2022, I thought it would be interesting to see how that stacks up against other tech, media, and sports titans.

There are many factors that dictate compensation ranging from exercising stock options to one-time awards, and performance bonuses, so compensation one year might not be indicative of the past or years to come.

Nonetheless, Sir Lucian Grainge finds himself amongst the highest-compensated CEOs for 2022. It’s fitting as the board described him as a “one-of-a-kind” executive when they approved his $50M compensation package and $100M stock option, which originally created some turbulence from top shareholders. This is in addition to the $300M package he received in 2021 when he helped take UMG public.

Under his leadership, the company’s revenues have grown from 4.2B Euros in 2011 to 10.34B Euros in 2022. The market cap is sitting at around 36B Euros and Sir Lucian has shepherded UMG through a major shift in the music industry to a strong public offering and beyond.

As reported by Billboard, Michael Rapino’s $139M compensation package for 2022 has recently come under fire from some shareholders.

With many of the media companies, executive compensation faces scrutiny because thousands of employees are getting laid off and stock prices are crumbling. However, with Live Nation, their stock price has almost doubled from where it was at 5 years ago.

Who are the people that approve these compensation packages at major music companies?

Let’s have a look.

“I would just like to say to this senior group of very respected graybeards that all I have ever personally asked is the chance to serve.” — Tom Wambsgans

Some of the most respected and accomplished business leaders across different industries reside on the boards of major music companies. You also have major shareholders making sure the company is being fiscally and operationally responsible. This includes looking at the future of the company and making sure it’s innovating.

Like WMG, Universal Music Group is innovating and is also diversifying its portfolio.

“Yeah, we're fine. I've had worse experiences. I once stayed at a Marriott.” — Roman Roy

Through a partnership with Dakia U-Ventures, UMG has launched an experiential hotel in Madrid and has plans to open additional locations in Mississippi, Georgia, and Florida. Honing in on the fact that music has a deep impact on fans, it will be interesting to see if these hotels achieve great success.

Like the other majors, UMG has also been very active in the investment space. I’m sure they want to avoid another Uber situation.

“The Hundred is Substack meets Masterclass meets The Economist meets The New Yorker.” — Kendall Roy

A lot of these startups have ties to music which strategically makes sense for all parties involved. Some of these companies have already gone out of business while others are flourishing. Nonetheless, a few correct bets can lead to massive gains. Music companies constantly have to be looking towards the future and where opportunities are going to lie.

In addition, they need to have new labels developed under their umbrella to increase market share and revenue.

"Smart people know what they are." — Logan Roy

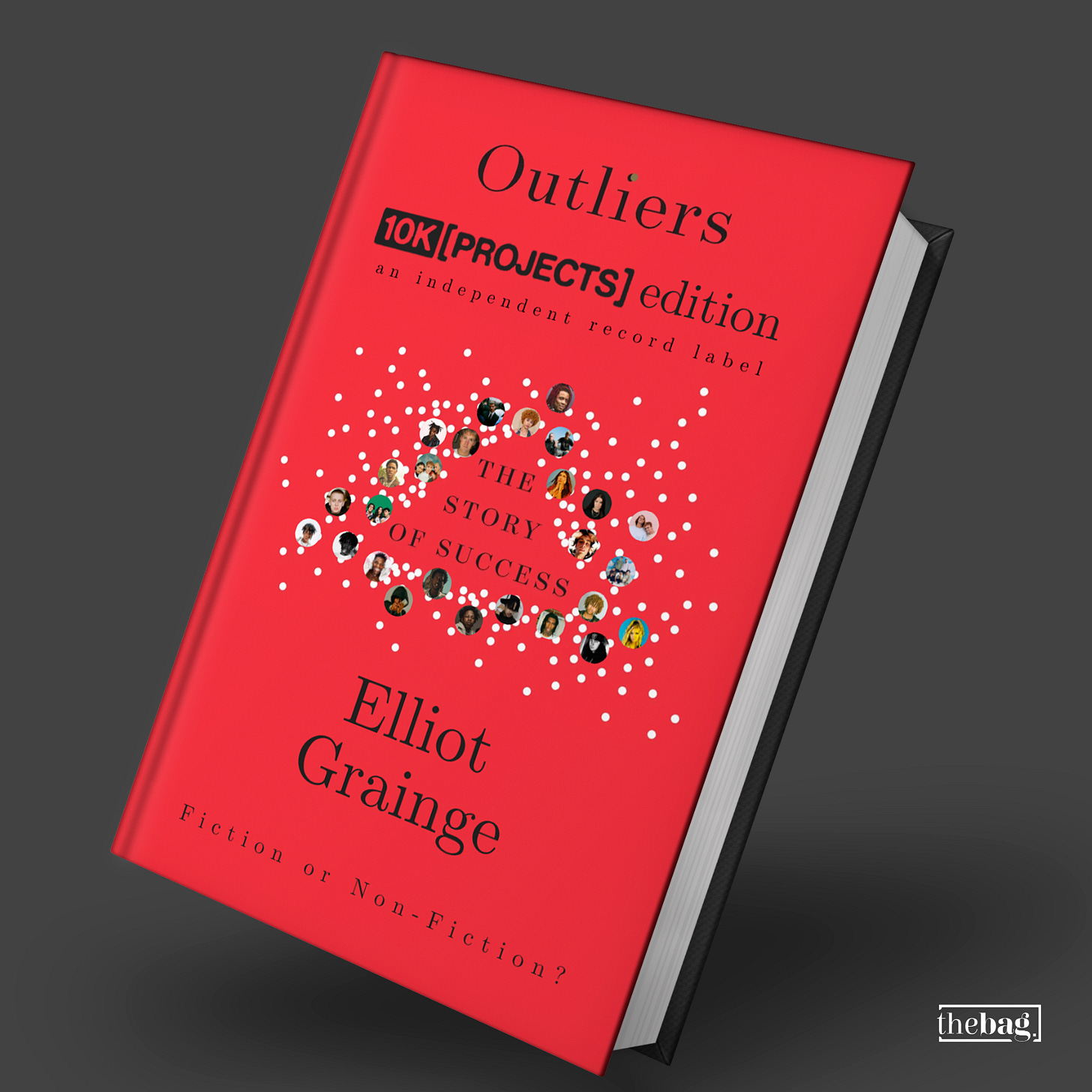

Elliot Grainge’s 10K Projects has achieved an enormous amount of success over the past seven years since its founding in 2016. Named after the 10,000-hour rule frequently referenced in Malcolm Gladwell’s book, Outliers, 10K Projects has seen massive success with artists such as 6ix9ine, Internet Money, Trippie Redd, Ice Spice, and Surfaces. With a hands-off approach and penchant for marketing on TikTok the “independent” label is seeing incredible results.

Elliot, the son of UMG boss, Sir Lucian Grainge provided the LA Times with an in-depth interview in April. While there is no denying the success of his label, there were several head-scratching comments made by the younger Grainge that left readers wondering, is he doing his best Kendall Roy impression or is he serious?

"I think our position must be that we're just done cornholing our dad." — Roman Roy

What I find most interesting is in context to which the 10K Projects honcho refers to major labels especially since his father runs the biggest of them. While he positions 10K Projects as an independent, for years they’ve been distributed by Capitol Records. I’d also be willing to bet they’ve historically received overhead capital and marketing support for their releases. He discredits the role of majors and their appeal to artists but also seems to need their partnership. If 10K Projects is an independent label then what is United Masters? UM is self-funded (through their investors and not a major label), self-marketed, and self-distributed. I’m not here to kick sand at Elliot’s beach chair, but the irony in all of this will be if 10K Projects sells a portion of their business to a major, which in his eyes is just “a conveyor belt with mediocre-at-best product management departments.”

"He's a guy we can do business with." — Kendall Roy

If you were to sell your company, who do you go see? Fred Davis would be a good starting point. Billboard did an excellent job at highlighting the work that he and his partners at The Raine Group have done. They’ve been involved in the financing and sales of companies including Quality Control, Gamma, Hitco, and Soundcloud amongst many others. The son of industry legend, Clive Davis, Fred sits at the intersection of talent, financing, and innovation.

Gerri Kellman: “That's where heroes are born, Tom. On the battlefield.”

Tom Wambsgans: “It's also commonly where they are killed, Gerri.”

Speaking of innovation, everywhere you look, there’s content about how AI is and will continue to impact different industries. Many in the music industry have strong feelings about it. Historically though, early adopters of new platforms and technologies have reaped big rewards. While the first on the dance floor may get laughed at, there’s also an opportunity to make lots of money, amass new fans where they are already spending their time, and raise your profile. Grimes is leaning in and lending her voice while super-producer, !llmind, has made a chatbot clone of himself. It will be interesting to see who else continues to innovate with AI and I’m not just referring to the talent.

“I’m seeing some confusion in the chat. Um, but yes, uh, if I have been too wordy, yes, we are letting all of you go. Obviously, I can’t take questions on this call, but this is a very sad day, and I thank you for your time today and your service to Waystar Royco. Goodbye.” — Greg Hirsch (Cousin Greg)

Smart executives and managers should be tinkering with AI Agents. There are plenty of mundane tasks that can be automated. All signs point to companies becoming more lean and nimble and if you’re smart, you’ll spend more time adopting new technologies instead of ignoring them. As Marc Andreessen shared, AI will save the world.

“Life's not a knight on horseback. It's a number on a piece of paper. It’s a fight for a knife in the mud.” — Logan Roy

Extremely informative. Thank you!